Veve Vortex: Exploring the Latest Trends

Stay updated with the latest in news, tech, and lifestyle.

Why Term Life Insurance Is the Secret Sauce for Financial Security

Unlock financial peace of mind! Discover why term life insurance is the ultimate secret to securing your family’s future today.

Understanding the Benefits of Term Life Insurance for Your Financial Future

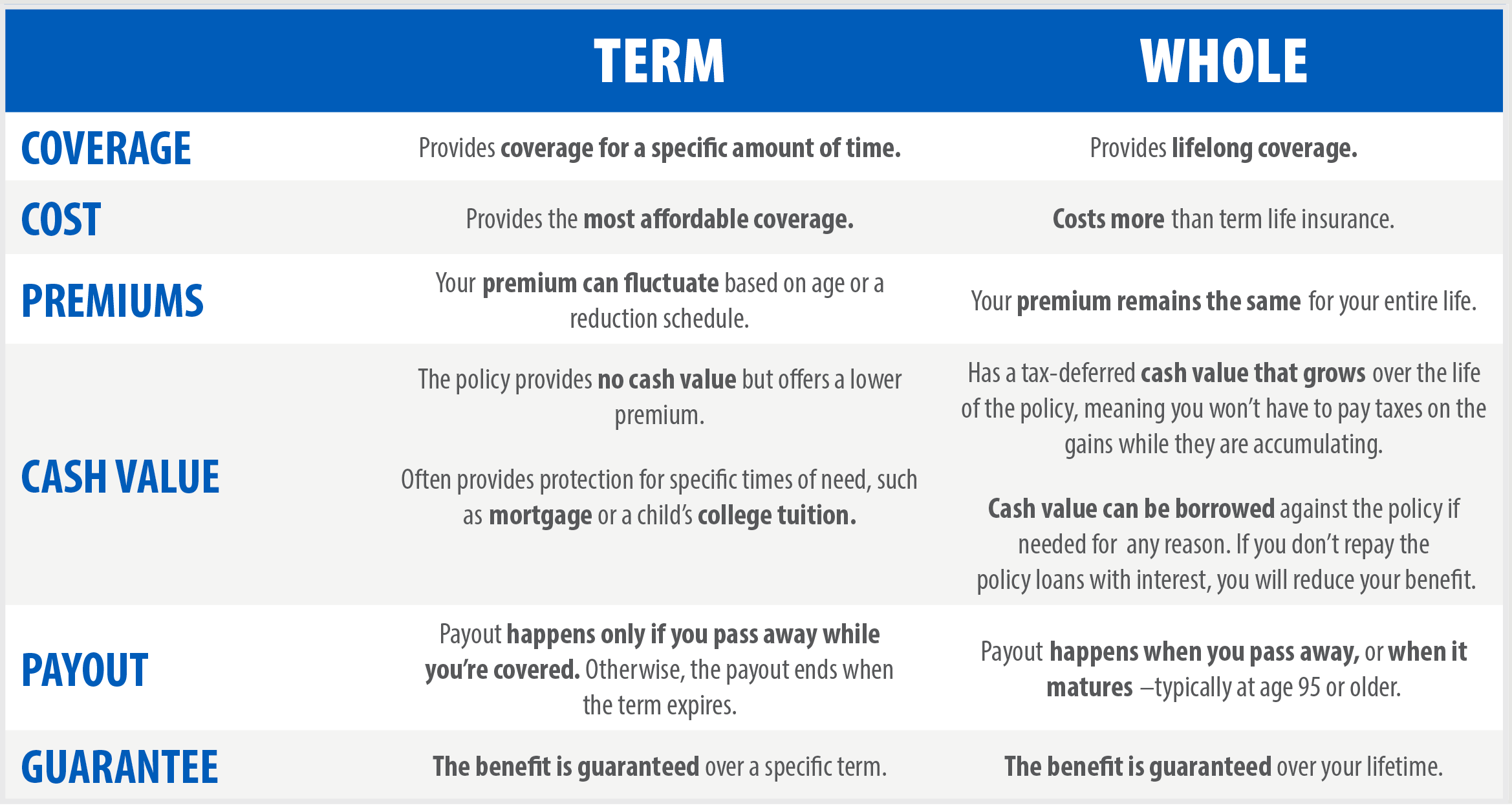

Term life insurance offers a variety of benefits that can secure your financial future and provide peace of mind for you and your loved ones. Unlike whole life insurance, term life is more affordable and straightforward. It provides coverage for a specific period, usually 10, 20, or 30 years, allowing you to choose a term that aligns with your financial goals. During this time, if something unexpected happens, your beneficiaries receive a death benefit that can be used for various purposes, such as paying off outstanding debts, covering mortgage payments, or even funding your children's education. This can ensure that your family's financial needs are met even in your absence.

Moreover, term life insurance can be an essential tool in financial planning. It helps you budget for future expenses without the long-term commitment associated with permanent policies. By investing in a term policy, you can allocate more resources to savings or investments that align with your long-term financial goals. For more insights on how term life insurance can fit into your overall financial strategy, consider visiting Investopedia or NerdWallet.

Is Term Life Insurance the Affordable Solution for Your Family's Security?

Term life insurance is often considered one of the most affordable solutions for providing your family's financial security. Unlike permanent life insurance policies, which can be significantly more expensive due to their investment component, term life insurance offers coverage for a specific period—usually 10, 20, or 30 years. This makes it a budget-friendly option for families looking to protect their loved ones without breaking the bank. According to a report by NerdWallet, premiums for term life insurance can start as low as $10 a month, making it accessible for most families.

Furthermore, choosing term life insurance allows you to customize your coverage based on your family’s needs. For instance, if your primary concern is to cover outstanding debts or to provide for children's education, you can opt for a term length that aligns with those financial responsibilities. The simplicity and transparency of term policies make them easy to understand, and many providers offer online tools to help you compare rates and coverage options. For detailed comparisons, you might refer to Policygenius to find the best options tailored to your family’s financial security needs.

How Term Life Insurance Can Protect Your Loved Ones: A Comprehensive Guide

Term life insurance is designed to provide financial security for your loved ones in the event of your untimely passing. This type of policy offers coverage for a specific period, usually ranging from 10 to 30 years. During this term, if the insured individual passes away, the beneficiaries will receive a death benefit that can help cover essential expenses such as mortgage payments, children's education, and daily living costs. By investing in a term life policy, you are ensuring that your family's financial future is protected, allowing them to maintain their standard of living in your absence. Learn more about the basics of term life insurance here.

Moreover, term life insurance tends to be more affordable than whole life policies, making it an appealing option for many individuals. It is crucial to assess your coverage needs and choose a policy that matches your financial goals. To reinforce the importance of term life insurance in your financial planning, consider these key factors:

- Assess how much coverage your family would need.

- Determine the length of time the coverage is required.

- Regularly review and adjust your policy as your life circumstances change.